National CRE Carnage & U.S. Banking Fragility

I am not an economist, and I don’t give financial advice, but 2024 is certainly going to be interesting. In last year’s annual letter, I suggested a reset in real estate would begin in 2023. Today, I am suggesting that while there are some bright spots in the market, that reset is likely in its early innings.

What’s happening in financial markets right now reminds me of what happened in early 2007 when subprime lenders began failing, followed by two large hedge funds in 2008, Bear Stearns & Lehman Brothers. You may recall the banking system blew up in August 2007, but the stock market didn’t peak until November of 2007. Eventually, the stock market followed suit, with the DJIA index falling more than half (51.1% from a peak on October 9, 2007, to a trough on March 5, 2009). The S&P 500 was hit even harder, falling 56.8% during a similar period, ending March 9, 2009. At the time, there were already huge losses in the financial system that banks were pretending didn’t exist.

While I am not sure it will play out anything like 2008, I do see many similarities in commercial real estate and corporate debt, today. Nationwide, a notable amount of real estate is already being handed back to lenders, written down and/or trading at much lower valuations. While most sector distress has been contained within the “office” market, I think that is what I find most concerning. An SSRN study titled, Monetary Tightening, Commercial Real Estate Distress, and US Bank Fragility cites, “44% of office loans appear to be in a “negative equity” where current property values are less than the outstanding loan balances.” To date, wide-spread destruction across the US office market has spawned from massive vacancies and a nationwide work-from-home movement, which likely means all the losses coming from higher interest rates haven’t been realized yet.

Quantifying Current CRE Losses

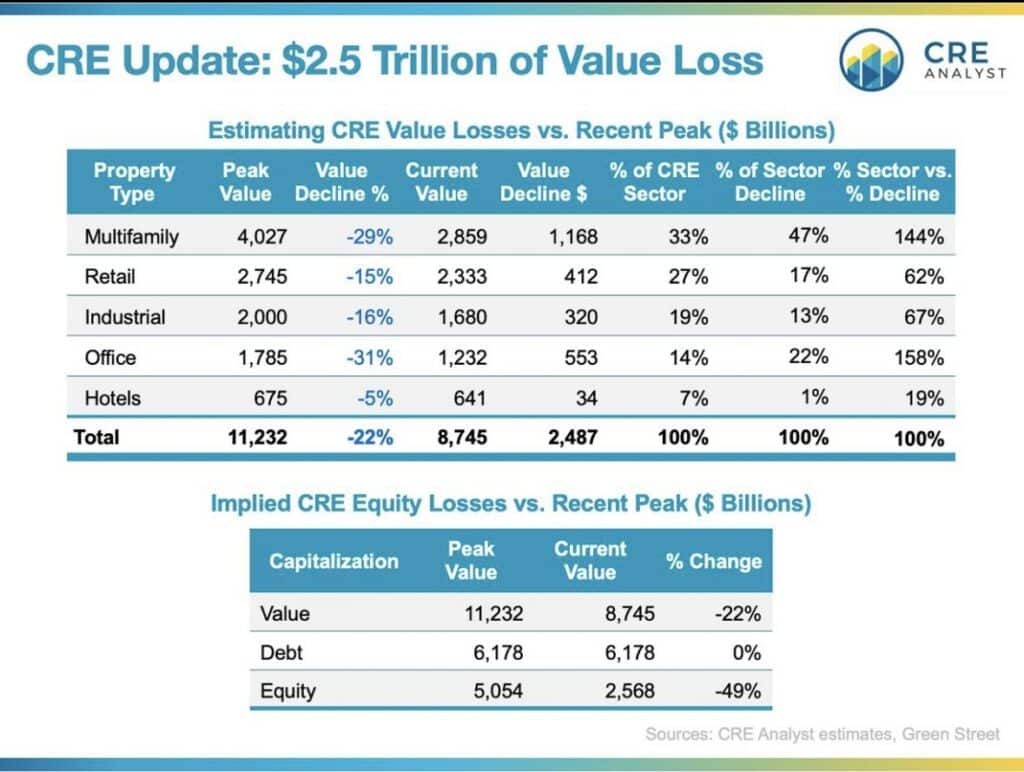

The below graphic from CRE Analyst sums up the likely losses that have already occurred in CRE:

CRE Analyst: Estimates “the U.S. CRE market was worth over $11 trillion 18 months ago and has fallen by nearly $2.5 trillion.” Source.

Expect Tight Credit, Regardless of Prospective Rate Reduction(s)

One of the big arguments around CRE valuations is that the Fed could begin cutting interest rates as early as Q1, next year, with some even projecting multiple quarter point rate reductions by the summer 2024. Such reductions could bolster valuations in CRE. If the Fed does start cutting rates next year, it’s likely because the labor market has crashed, and we are in a recession. Last time I checked, a recession is not good for asset valuations. Nor, is it great for credit, as credit markets tighten during economic slowdowns and underwriting standards become more stringent, not less. In my view, if the Fed cuts rates too soon, they run the risk of reigniting inflationary pressures that further impact per capita spending, savings, and sentiment. It’s sort of a rock and a hard place situation. Other indicators tell us that…

While inflation has slowed, prices have not decreased. They continue to rise, just at a reduced rate of inflation. The U.S. Bureau of Labor Statistics cites, “The all items [CPI] index rose 3.1 percent for the 12 months ending November [2023], a smaller increase than the 3.2-percent increase for the 12 months ending October.” But, keep in mind, 3.2% is still more than 50% above the Fed’s stated target of 2.0%.

In addition to CRE distress, major bank failures in March 2023 can’t go without mention; unless you’re the Fed. The bank failures quickly became a “non-event” due to the Fed swiftly papering over them. But I believe banks at all levels still face immense exposure and we will see many more bank failures in 2024/2025. Right now, the conventional wisdom is that large banks are in “good shape” and those failures in early 2023 were simply asset duration mismatches that caused a short-term panic. There is fear that more regional and community banks could fail due to these same duration mismatches, deposit slippage, and/or CRE losses, but again, the consensus is that all the major banks are in “good shape”.

Maybe that’s true of JP Morgan, but Citi bank recently announced a major restructuring that will likely result in many thousands of layoffs. I think the real loser among major banks, though, will be Bank of America (“BAC”).

If you are a BAC customer with significant deposits held there, I would have to ask you, why? BAC is paying less than 1% on your deposits, while you could get 5% on short-term US T-bills. Why doesn’t BAC just pay more interest to their depositors? They can’t. BAC has the same duration mismatch that SVB and First Republic had, only much bigger. BAC bought massive amounts of long-dated treasuries when rates were at all-time lows. Now, they are stuck with them. A huge chunk of BAC’s balance sheet is tied up in treasuries that yield less than 2%. In fact, according to Q3 financials, BAC has an unrecognized loss on its’ securities portfolio which amounts to more than $130B. To put that into perspective, BAC’s entire market cap (as I write this) is $242B.

The good news for BAC? They don’t have to recognize that loss if they don’t sell those long-dated treasuries, but it also means BAC won’t be able to pay a competitive interest rate for a long time to come. If customers continue to pull their deposits from BAC because of paltry depositor yield, it eventually turns into a major issue. This situation is not unique to BAC, either. There are a multitude of banks, local to global, that have the same problems. Banks will continue to lose deposits if interest rates stay here, and that’s just one of the challenges banks will face in 2024.

Banks and other financial institutions have already had a very difficult year, while the actual downside from CRE losses and bankruptcies has likely just begun. What happens when a wave of loans made in the last several years at ultra-low rates start to mature? Many businesses and real estate investors are going to be forced to liquidate or bring a lot more equity to the table to refinance their debt. Many major companies in the U.S. will find themselves in the same predicament. Of course, the Fed will eventually wake up and be forced to cut rates, maybe even as early as Q1 next year, but that doesn’t mean credit markets will suddenly loosen. In fact, if the US enters a full-blown recession, credit will likely tighten further. And, if we see some major failures in the credit markets, the spreads on those interest rates will also explode, making it even harder to borrow money.

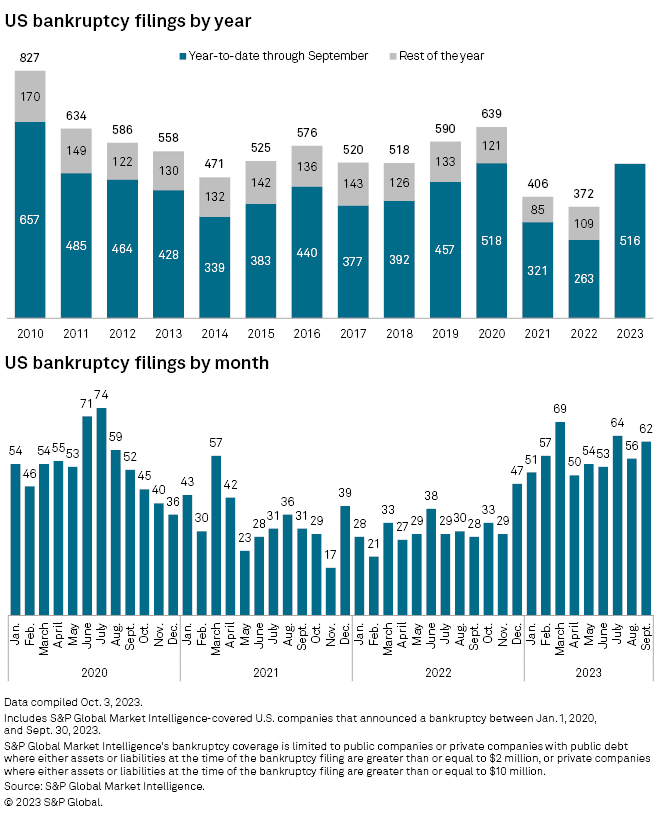

Global Market Intelligence: “US corporate bankruptcies showed no signs of slowing in September, closing out the quarter with the most bankruptcies so far in 2023.” Source.

Liquidity Locked & Loaded

The good news in my mind? There appears to be a notable amount of cash on the sidelines, and a significant number of investment groups waiting to buy distressed assets of all types. Will it be enough? I don’t know. What I do know is unlike 2008, there seems to be a lot more liquidity ready to be deployed at better valuations, and that could keep us from seeing a cascade of distressed selling. Regardless, I think it’s an ideal time to find great deals. From what I have observed, there are far less buyers in the market for the deal types and size that Fortius targets. Many of the sellers we are talking to have finally come to the realization that 2021 prices are a thing of the past.

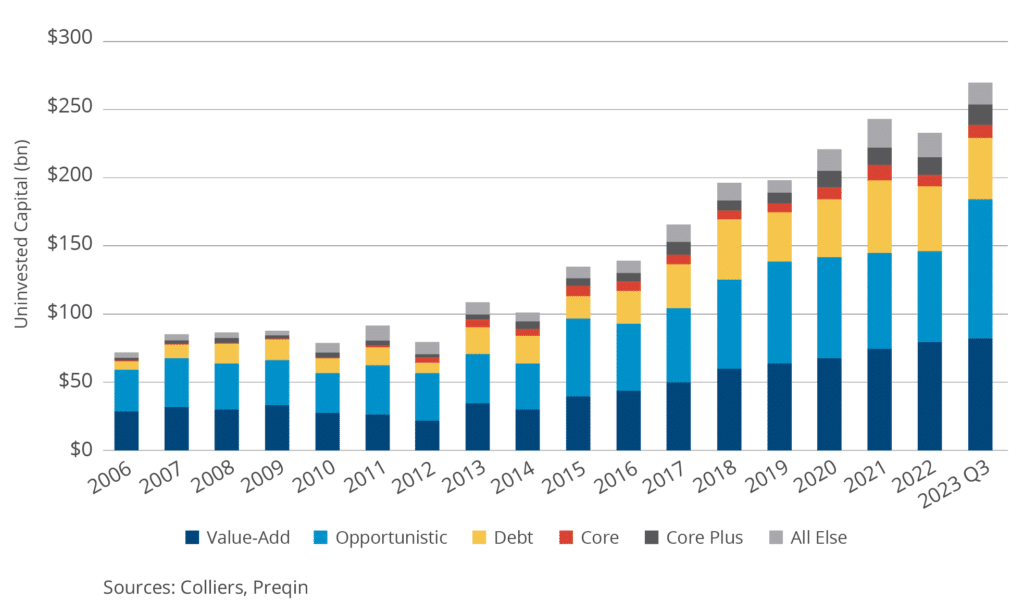

Colliers + Prequin: Sidelined Capital is positioned to pounce. “With commercial real estate investors waiting to deploy $270.6 billion, per Preqin, more cash than ever is available to spend.” Source.

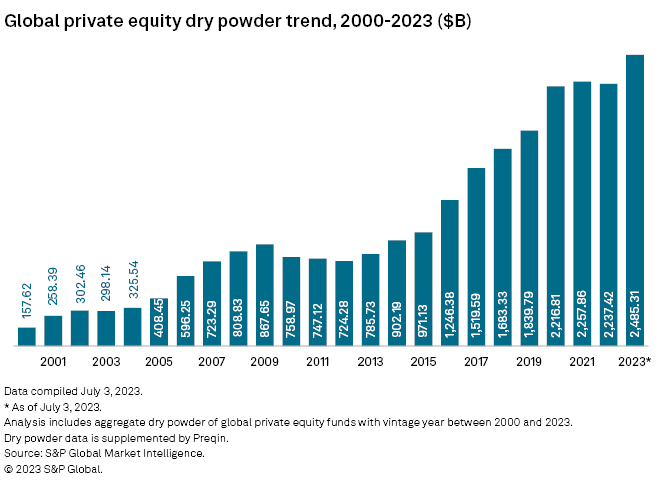

S&P Global: “Global private equity dry powder soared to a record $2.49 trillion around the middle of 2023 as sluggish dealmaking limited opportunities for the deployment of uncommitted capital into buyouts and other investments.” Source.

New Year: Patience Pays

To bring it all home, I am still bullish on select housing markets. I believe residential prices will pull back, but I also know that we still have a significant housing shortage in the markets we operate in, particularly for entry-level housing. This presents an opportunity. I will continue pursuing quality RV park assets, with an emphasis on parks that also serve as an extended stay product. Something is telling me that 2024 may bring some attractive value-add commercial opportunities in mountain markets for the first time in many years as well. If those opportunities materialize, we will be ready to jump. I am hanging onto plenty of liquidity, most of which is in T-Bills, and I am looking for great assets that can produce outsized returns. My final advice for 2023?

T-Bill and Chill.

May you and your family have a safe and spirited New Year!

Happy New Year,

Mike Pearson

President