Ignorance Does Not Equal Financial Bliss.

I don’t know what the financial markets will look like twelve months from now, nor can I accurately predict what the markets will look like in two or three years. What do I know? A ton of dumb deals are being made all over the place, at record pace. I am sure there are many reasons for this, but I believe it boils down to a couple of key factors.

Rather than chasing yield, we need to create it.

– Unknown

Kicking the Can

First, there is way too much money chasing far too few deals. Second, there is a clear belief among many large (institutional) and small investors that the Federal Reserve has their back and will flood the market with liquidity if asset prices go into a free fall, as they did in early 2020.

Perhaps, they are correct and Central Banks will do exactly that. It’s hard to disagree with this position when you consider the massive government intervention into financial markets that we saw in the Spring of 2020. Let’s not forget, the Fed broke all precedence in 2020 and bought pretty much everything — including corporate debt to prop up markets. My questions are simple — was the crises averted, or did they just kick the can down the road? The financial data I follow highlights the latter. Thus, the real question is how far down the road did they kick that can, actually?

The Corporate Bond Market

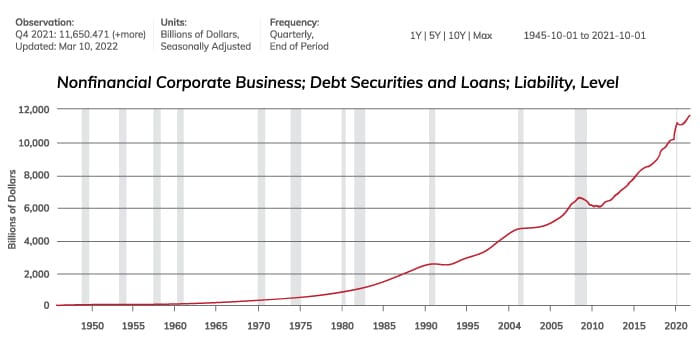

I believe the corporate bond market is a solid marker to track for signs of future distress, or to identify how distorted capital markets have become. Total Corporate Debt has nearly doubled since the 2008 financial crisis, reaching roughly $11 trillion. To put that in perspective, that is more than half of total U.S. GDP. A snapshot of total corporate debt is below.

Source: Board of Governors of the Federal Reserve System (US), Nonfinancial Corporate Business; Debt Securities and Loans; Liability, Level [BCNSDODNS], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/BCNSDODNS, March 10, 2022.

Yield at Any Cost

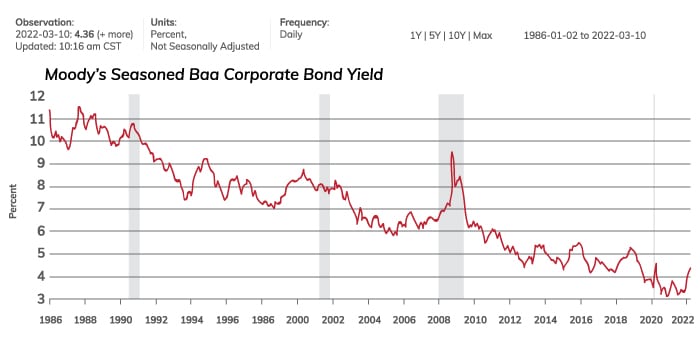

To measure volatility (fear) in the corporate bond market, a good indicator is to look at the spread between U.S. Treasuries and High Yield (junk) corporate bonds with similar maturity dates. The spread between junk bonds and U.S. Treasuries is around 350 basis points (bps), which is well below the historic average of roughly 600 bps. As we speak, investors are taking on unprecedented risk in the lowest interest rate environment in history. Essentially, investors are chasing yield at any cost.

Source: Moody’s, Moody’s Seasoned Baa Corporate Bond Yield [DBAA], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/DBAA, March 10, 2022.

The Walking Dead

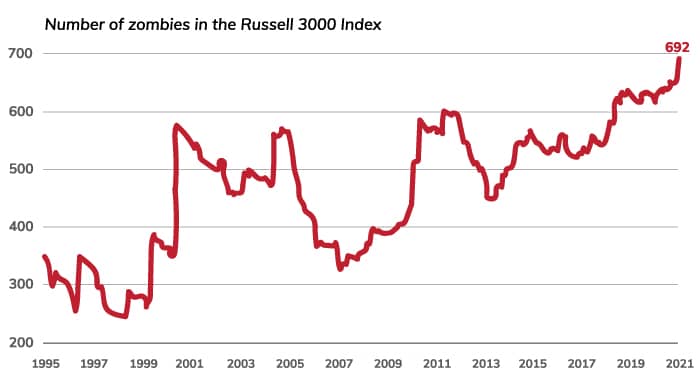

Now, let’s look at the number of Zombie companies in the United States. Zombie companies are businesses that cannot afford its own debt load. They don’t earn enough profit to service their debt, or even cover the interest carry in many cases. They are only kept afloat by the willingness of creditors (investors chasing yield) to continue lending them more money.

You may think this is a rare event, but you would be wrong. Even before the pandemic pushed the U.S. economy into the shortest recession ever, the number of Zombie companies were near all-time highs.

The Pandemic only exacerbated this situation, and according to the Bank of International Settlements, we are at record highs with approximately 24% of U.S. Companies not earning enough to service their own debt. Nils Kuhlwein, of consulting firm Kearney, explained this well in a recent CNBC interview.

Source: Bloomberg, using monthly data as of 1/31/2021. Zombie companies are defined as those in the Russell 3000 Index (RAY Index) whose average 3-year interest coverage ratio was less than one.

Interest Rate Sensitivity

In a rare moment of clarity, President Biden made it apparent that inflation is a serious liability for the United States and the current administration. To combat inflation, the Central Bank has already begun tapering purchases of treasuries and has suggested they will likely raise the Fed Funds Rate in the first half of this year. Considering nearly one in four U.S. companies cannot service their debt at current interest rates, it makes me wonder what will happen to credit markets if rates move even modestly higher from here. If the economy does begin to spudder, the consensus is that we will see additional stimulus, but doesn’t that just create more inflation? The entire U.S. economy is more interest rate sensitive than it has ever been, and financial markets are at all-time highs. I am not rushing out to sell everything I own, but counter-party risk has become relevant again.

In a global economy that is largely driven by credit, interest rates matter to everyone, especially U.S. rates. Outside a few short-term development projects in Fortius Capital’s pipeline, my goal remains: create long term, income producing projects that outperform in any interest rate environment. In fact, I believe a project like River Dance, will likely benefit from higher interest rates due to renters and buyers being priced out of many traditional housing options, as rates continue to creep upward. This hikes the demand for affordable housing options even further, as many hopeful homeowners-to-be face the unrealistic cost of homeownership in markets, like Eagle County, where the single-family median home price exceeds $1M. Providing such housing options in constrained markets with products (like tiny homes, mobile homes, RV Parks, and ground lease communities) makes Fortius Capital the lender of last resort. This solidifies a good investment and serves a critical function to the communities we serve.

Cashflow, Cashflow, Cashflow

As many of our equity partners are also prioritizing cash flow, we aim to fill that need. However, we intend to deliver cash flow with projects that hold substantially less risk than simply throwing our hat in a bidding war for overpriced real estate assets, which is the equivalent of buying corporate bonds at a premium to the historic spread.

When considering Fortius Capital’s current investor stable, we have more investors than investable deals. That will change, and when it does, I hope my advice to hold plenty of cash has not fallen on deaf ears. For those hungry to get in on an upcoming Fortius project, we will continue sifting through deals across mountain markets in search of hidden gems, like we speculate with River Dance. If you have not been awarded an allocation in the River Dance project, please be patient. More opportunities will come, but as deal sponsor, our goal holds true: find asymmetric opportunities, rather than trying to merely grow Fortius Capital’s assets under management. This is the Fortius Capital way — to remain steadfast and disciplined in our investment approach and highly protective of our investors’ resources in the name of creating yield, not chasing it.

Here’s to the road ahead…

Best Regards,

Mike Pearson

President, Fortius Capital